Business Loans

Get Funded and Grow Your BusinessBusiness Term Loans

Term loans allow business owners to borrow capital at a fixed rate and with an affordable payment term.

Pros

- Quick funding options with fewer requirements

- Fixed payment structure

- Can be used for a wide range of business needs

- Easy to finance larger projects or expansions

Cons

- Shorter-term loans can be expensive

- Interest rates vary depending on FICO

- Potential prepayment penalties

Business Lines of Credit

Line of credit gives business owners access to capital to buy inventory and handle seasonal cash flow gaps.

Pros

- Only pay interest on funds drawn

- Capital is available when needed

- Great way to build business credit

Cons

- Can be harder to qualify for

- Credit cards are viable options but come with higher rates

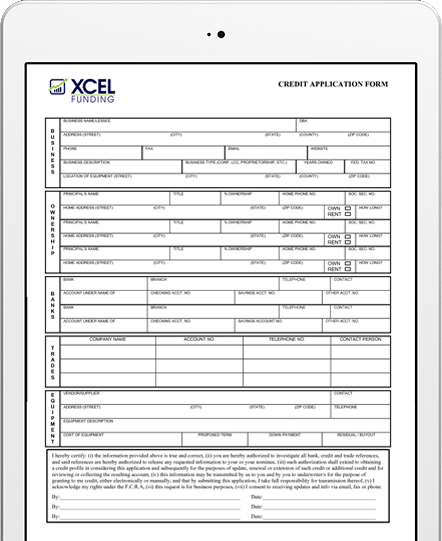

Equipment Financing

Equipment financing allows business owners to lease or purchase equipment for their business needs.

Pros

- Quick funding times for equipment purchases

- Equipment can serve as collateral for the loan

- Affordable interest rates and longer terms

- Limited paperwork and easier to qualify for

Cons

- Equipment can depreciate by the time the loan is paid off

- May require a down payment

- Terms may vary depend on equipment type

Let's Do Business!

We pride ourselves on our client relationships and offering the right solutions.